Shopping cart

- +92 343 7893123

- info@onlinesolutionsworld.com

- Mon - Sat: 8:00 - 15:00

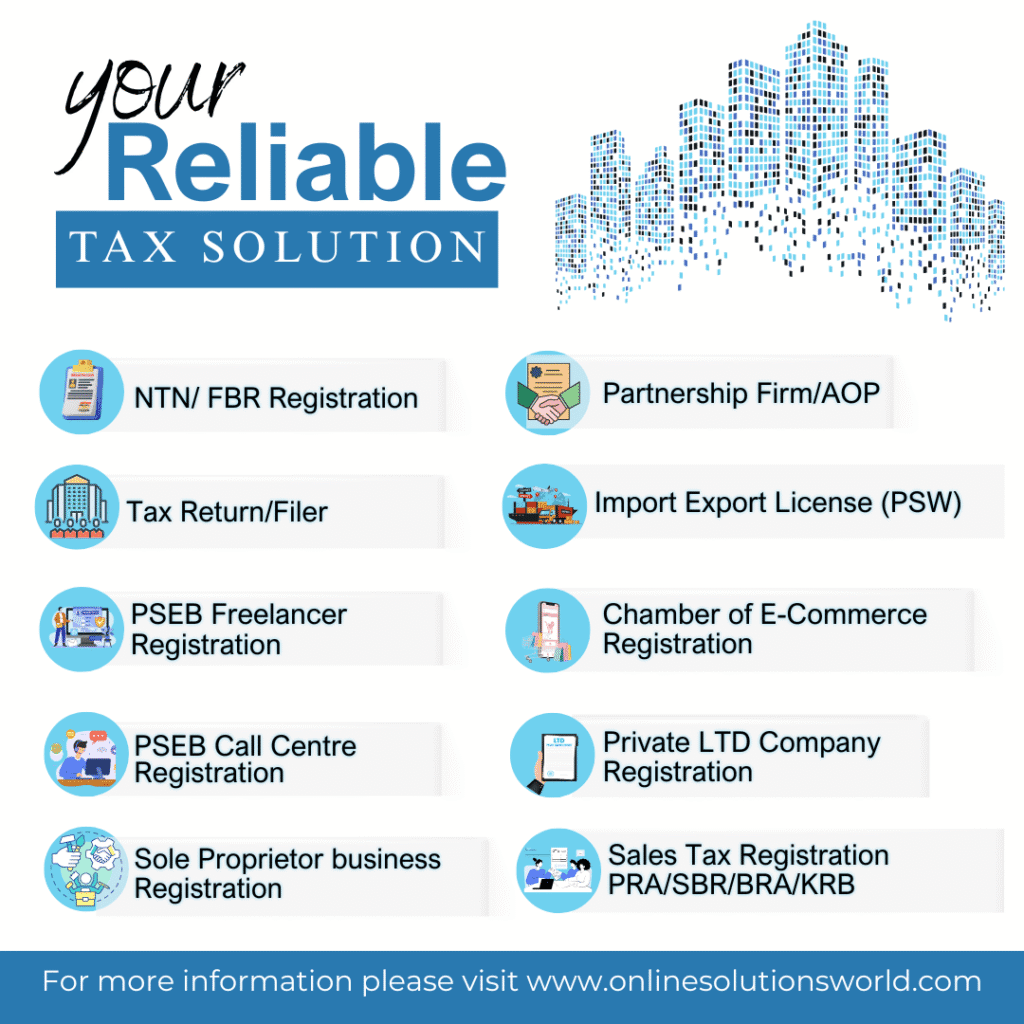

Income tax filing is the process of submitting tax returns to the Federal Board of Revenue (FBR) by individuals and businesses to report their income and pay taxes. Our expert services ensure accurate and timely filing, helping you comply with tax laws and regulations.

Filing income tax returns is crucial for individuals and businesses in Pakistan, as it ensures compliance with tax laws, avoiding penalties, fines, and notices from the FBR, while also contributing to the country’s economic growth and development. By filing tax returns, individuals and businesses can claim refunds, deductions, and exemptions, reducing their tax liability and increasing their savings. development and growth.

Online Solutions World provides comprehensive annual income tax filing services to individuals and businesses in Pakistan. Our experienced professionals ensure accurate and timely tax filing, helping you comply with the Income Tax Ordinance, 2001, and regulations set by the Federal Board of Revenue (FBR).

1- Accurate tax return preparation and filing

2- Timely filing to avoid penalties and fines

3- Strategic tax planning to minimize liability

4- Expert representation during tax audits

5- Compliance and risk management

6- Claiming tax refunds and credits

7- Preparation and maintenance of tax documentation

8- Personalized service tailored to client needs

9- Data security and confidentiality

– Compliance with tax laws and regulations

– Avoidance of penalties and fines

– Claiming refunds and tax credits

– Enhanced financial planning and decision-making

Call:

+923437893123Office location:

Doctor's rd, Housing Colony, ShorkotCopyright © 2024 Online Solutions World | All Rights Reserved

WhatsApp us